When a company is considering an investment or project, it might use NPV to evaluate its future earnings today. The NPV considers inflation and interest rates to give you a more accurate idea of how valuable your investment might be. Besides all the day-to-day spending, like staffing, utilities, and premises, they must decide whether and how to reinvest any profits. Capital budgeting is simply part of the broader challenges of bookkeeping for any business. Many investments are long-term, so committing to a project is a decision that can affect the financial future of the company. The benefit of automation is that the obvious items can be automatically included or excluded, and management attention can be focused on the marginal items.

Scenario analysis evaluates multiple outcomes

- Most execute only a limited number of high-value, complex, multi-year projects.

- Use this capital budgeting technique to find the discount rate that’ll bring a project’s net present value to zero.

- Capital budgeting decisions cannot be taken lightly, they require complete analysis and evaluation of the costs and outcomes.

- Given what we know about the cash flow estimates above, we evaluate whether or not the project will help us add value for shareholders.

A robust capital budgeting process incorporates sophisticated forecasting techniques to predict future cash flows with greater precision. Whatever capital budgeting decisions one makes, project management software can help track those costs. ProjectManager is award-winning project management software that tracks capital budgets in real time. Managers can toggle over to our live dashboard whenever they want to get a high-level overview of their capital budget.

What is Capital Budgeting? Process, Methods, Formula, Examples

Organizations must consider technological obsolescence, market changes, and maintenance requirements when determining appropriate project timeframes and investment horizons. This straightforward technique calculates the time required to recover the initial investment through project cash flows. Determine all upfront expenses including equipment purchases, infrastructure development, training costs, and working capital requirements. Consider both direct and indirect costs, ensuring all potential expenditures are accurately accounted for in the initial investment calculation.

What is your current financial priority?

A similar consideration is that of a longer period, potentially bringing in greater cash flows during a payback period. In such a case, if the company selects the projects based solely on the payback period and without considering the 4 ways to calculate depreciation on fixed assets cash flows, then this could prove detrimental for the financial prospects of the company. Despite being an easy and time-efficient method, the Payback Period cannot be called optimum as it does not consider the time value of money.

While making capital budgeting approval decisions, it must be borne in mind that the chosen project will not only pay back the original cost of investment but also generate substantial profits. This isn’t just for large corporations; even small companies, like ones that handle small company payroll services, use capital budgeting. The purpose of capital budgeting is to assess the full suite of candidate projects and allocate funding to the most important and high value items. The fact that a project has been budgeted does not, however, mean that it will necessarily be executed. Not all projects that get executed will have been budgeted, as some critical investments will be required during the year that were not considered during the budgeting cycle.

How comfortable are you with investing?

Stakeholder engagement is a crucial element of successful capital budgeting, ensuring that investment decisions consider multiple perspectives and maintain broad organizational support. Effective stakeholder involvement helps create more robust project evaluations, better risk management, and a stronger commitment to project success across the organization. Calculate the time required to recover the initial investment through project cash flows. Consider both simple and discounted payback periods to understand how quickly the investment can be recovered and when positive returns begin. Evaluating capital investment projects is what the NPV method helps the companies with.

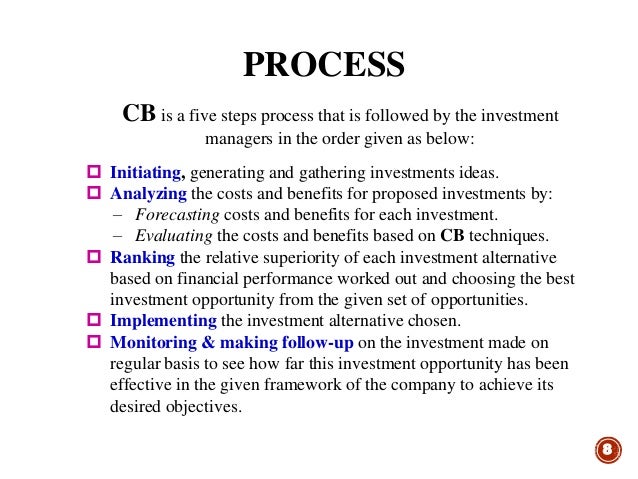

Share insights across the organization to improve future capital budgeting processes and project implementations. Review all proposed projects against established criteria to create a focused list of viable opportunities. This process helps eliminate projects that don’t meet basic requirements, allowing resources to be concentrated on analyzing the most promising investment options. Since the capital budgeting process is based on the analysis of cash flow, loan payments are included in the analysis, but non-cash accounting entries, such as depreciation, are not. Capital budgeting is more than just assigning capital as a budget item, as the name might suggest. In fact, it’s a whole process that companies use to examine potential projects or other investments to determine if they’re viable and profitable.

Encourage cross-functional teams to propose innovative investment opportunities through structured brainstorming sessions and regular business reviews. This proactive approach helps identify potential projects that could enhance operational efficiency, expand market reach, or introduce new products and services into the market. If you are comparing several investment possibilities, the next step is to calculate the internal rate of return (IRR) for each project to find the one with the highest return. Investopedia defines IRR as the discount rate at which the NPV of cash flow equals zero.

Payback analysis is usually used when companies have only a limited amount of funds (or liquidity) to invest in a project, and therefore need to know how quickly they can get back their investment. After the decision-making step, the next step is to classify the investment outlays into higher and smaller value investments. If the investment limit extends, the lower management must involve the top management to approve the investment proposal.

Implement robust data collection and verification systems to ensure accuracy and consistency. Establish partnerships with reliable market research firms and industry experts. Establish regular communication channels and feedback mechanisms among all stakeholders.

Cumulative net cash flow is the running total of cash flows at the end of each period. Keeping this in mind, a manager must choose a project that provides a rate of return that is more than the cost of financing a particular project, and they must therefore value a project in terms of cost and benefit. As a manager, it is important for you to understand the characteristics of capital budgeting and how these can affect your business. Capital budgeting is a method of assessing the profitability and appraisal of business projects by comparing their Cash Flow with cost.