Following capital budgeting process steps enable businesses to make informed capital budgeting decisions. The projects and investments that require capital budgeting are often on the wish list of the company. Companies usually consider these investments over time as they expand their business operations. When the value of the future cash flows exceeds the cost/investment, then the new venture is said to create potential value for the business and it makes sense to pursue the project to extract its value. Due to the limited availability of capital for new projects, management resorts to capital budgeting methods to determine which project will yield the highest return over an applicable period. Before going on to the capital budgeting process, let us first understand what business capital is.

Deliver your projectson time and on budget

Tracking actual performance against projections presents ongoing challenges, particularly for long-term projects. Advanced evaluation methods often require sophisticated financial modeling skills and a deep understanding of various assumptions. Determining appropriate discount rates and adjusting for inflation presents significant challenges, especially in volatile economic environments. The interconnected nature of best invoice management software to streamline ap process these risks and their potential compound effects makes comprehensive risk assessment particularly complex and challenging. Organizations must consider market risks, operational uncertainties, regulatory changes, and technological obsolescence. Organizations should be prepared for seasonal fluctuations, industry payment terms, and potential changes in working capital needs as the project scales or matures over time.

Ask Any Financial Question

Therefore, an expanded time horizon could be a potential problem while computing figures with capital budgeting. When the value of an investment is lower and approved by the lower management level, then for getting speedy actions, they are generally covered with blanket appropriations. But, if the investment outlay is of higher value, it will become part of the capital budget after taking the necessary approvals. These appropriations aim to analyze the investment performance during its implementation. Using workflow automation solutions like Cflow can simplify the process of performing complex calculations in capital budgeting.

Track Project Costs, Budget and Performance

Develop comprehensive screening parameters that include financial thresholds, technical requirements, resource availability, and alignment with company values. These criteria serve as initial filters to evaluate whether potential projects deserve detailed analysis and further consideration. Analyze current market conditions, competitor activities, and industry developments to identify emerging opportunities.

Challenges in engaging stakeholders effectively

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The process involves a comparison of Financial vs. Economic rate of return, Internal Rate of Return (IRR), Net Present Value (NPV), and Profitability Index (PI). As mentioned earlier, these are long-term and substantial capital investments, which are made with the intention of increasing profits in the coming years.

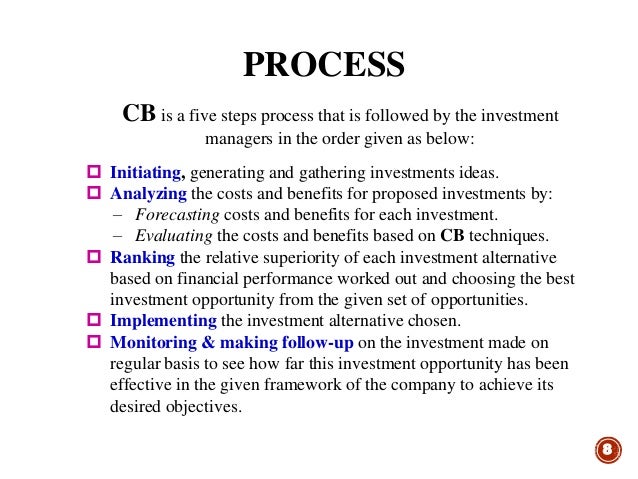

Process of capital budgeting in financial management

Using the methods above, you can rank the projects and choose the one that potentially has the greatest benefits to the organization. Of course, one of the most important of those benefits is which project will prove most profitable. When looking at the net present value of a project, you’re viewing the excess of cash inflows beyond cash outflows, adjusting both streams for the time value of money. This results in a positive or negative monetary value, positive adding value and negative reducing it. An IRR that is higher than the weighted average cost of capital suggests that the capital project is a profitable endeavor and vice versa.

Capital budgeting represents the plans for appropriations of expenditure for fixed assets during the budget period. The total capital (long/short term) of a company is used in fixed assets and current assets of the firm. Given what we know about the cash flow estimates above, we evaluate whether or not the project will help us add value for shareholders.

- The IRR method considers the time value of money for calculating capital budgeting.

- Capital expenditure control – Estimating the cost of investment enables companies to control and manage the required capital expenditures.

- After the project has been finalized, the other components need to be attended to.

- A capital budget is a financial plan that outlines long-term investments in assets expected to generate future cash flows.

- The process considers factors like development timelines, success probabilities, market potential, and competitive advantages while assessing the strategic value of innovation investments.

Companies will often periodically reforecast their capital budget as the project moves along. The importance of a capital budget is to proactively plan ahead for large cash outflows that, once they start, should not stop unless the company is willing to face major potential project delay costs or losses. Companies use different metrics to track the performance of a potential project, and there are various methods to capital budgeting. Although capital budgeting provides a lot of insight into the future prospects of a business, it cannot be termed a flawless method after all.

Or it could be used by a farmer who is thinking about leasing more acres and will need to purchase a harvester and cultivator to handle the additional workload. Next time you face an investment decision, walk through these seven steps of capital budgeting. The capital budgeting process used by managers depends on the size and complexity of the project to be evaluated, the size of the organisation, and the position of the manager in the organisation. Profitability Index is the present value of a project’s future cash flows divided by initial cash outlay. The NPV is the difference between the present value of future cash flows and the initial cash outlay.

This systematic approach to cash flow forecasting helps organizations develop realistic projections and make informed investment decisions while considering various financial aspects and market dynamics. The objective of the capital budgeting process is to allocate human and capital resources to the projects that will deliver the greatest strategic value to an organization. Once an opportunity has been identified and proposed, the company needs to evaluate its profitability by estimating its future cash flows and any potential risk involved. Since all these factors may impact a project’s ability to generate cash in future, companies must gather updates on them as their capital budgeting process moves forward.