These include the cost of goods sold (COGS) as well as selling, general, and administrative costs (SG&A). The two expense categories may contain both fixed and variable costs, which is why it can be useful to separate them using a contribution format statement. Unlike a traditional income statement, the expenses are bifurcated based on how the cost behaves. Variable cost includes direct material, direct labor, variable overheads, and fixed overheads.

- Imagine you have a lemonade stand; the more lemonade you sell, the more sugar and cups you need.

- The contribution margin ratio for the birdbath implies that, for every $1 generated by the sale of a Blue Jay Model, they have $0.80 that contributes to fixed costs and profit.

- Before making any major business decision, you should look at other profit measures as well.

- Direct materials are often typical variable costs, because you normally use more direct materials when you produce more items.

- You might have been thinking that the contribution margin sounds like EBIT or EBITDA, but they’re actually pretty different.

Contribution Margin

If a company uses the latest technology, such as online ordering and delivery, this may help the company attract a new type of customer or create loyalty with longstanding customers. In addition, although fixed costs are riskier because they exist regardless of the sales level, once those fixed costs are met, profits grow. All of these new trends result in changes in the composition of fixed and variable costs for a company and it is this composition that helps determine a company’s profit. This demonstrates that, for every Cardinal model they sell, they will have \(\$60\) to contribute toward covering fixed costs and, if there is any left, toward profit. The contribution margin is different from the gross profit margin, the difference between sales revenue and the cost of goods sold.

Example 2 – multi product company:

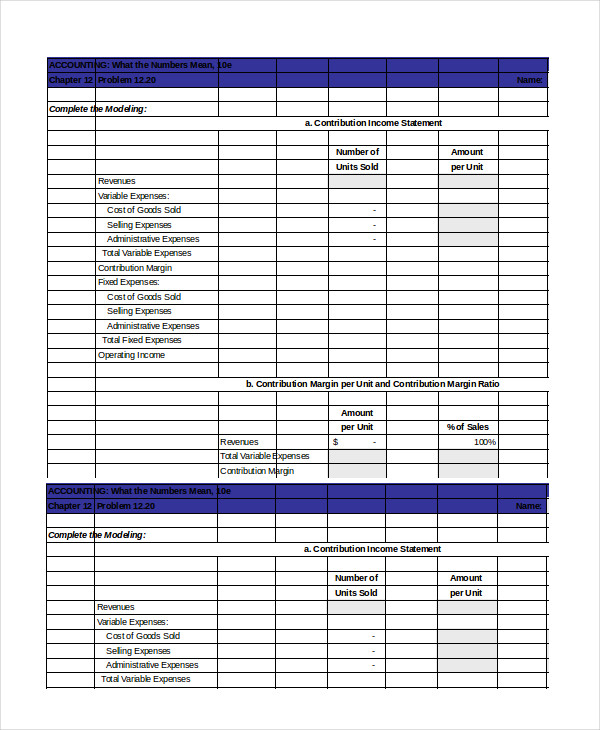

The basic difference between a traditional income statement and a contribution margin income statement lies in the treatment of variable and fixed expenses for a period. The difference in treatment of these two types of costs affects the format and uses of two statements. In our example, the sales revenue from one shirt is $15 and the variable cost of one shirt is $10, so the individual contribution margin is $5. This $5 contribution margin is assumed to first cover fixed costs first and then realized as profit.

Understanding the Impact of Variable Costs

It’s used in making big decisions, like how to price products and how much needs to be sold to keep the business healthy. This information is often shared in income statements for external review, showing how the business is doing overall. The contribution margin income statement shows fixed and variable components of cost information. This statement provides a clearer picture of which costs change and which costs remain the same with changes in levels of activity. This statement also shows “fixed costs,” the money you spend no matter how much lemonade you sell, like the stand’s rent.

Example 1 – single product:

In many businesses, the contribution margin will be substantially higher than the gross margin, because such a large proportion of its production costs are fixed, and few of its selling and administrative expenses are variable. For the month of April, sales from the Blue Jay Model contributed $36,000 toward fixed costs. Looking at contribution margin in total allows managers to evaluate whether a particular product is profitable and how the sales revenue from that product contributes to the overall profitability of the company. In fact, we can create a specialized income statement called a contribution margin income statement to determine how changes in sales volume impact the bottom line. For the month of April, sales from the Blue Jay Model contributed \(\$36,000\) toward fixed costs. Fixed costs include all fixed costs, whether they are product costs (overhead) or period costs (selling and administrative).

Contribution Format Income Statement: Definition and Example

If variable expenses were $250,000, so you’d have $385 in variable expenses per unit (variable expenses÷units sold). This gives a much more detailed financial picture of the business’s operating costs and how well the products perform. Depending on the type of business, either EBIT or EBITDA can be a better measure of the company’s profitability. It’s important to note this is a very simplified look at a contribution margin income statement format. To work out the contribution margin, you need to understand the difference between an item’s fixed and variable expenses.

In short, understanding variable costs and how they relate to the contribution margin is key for any business. It’s one of the performance indicators that can tell you a lot about how well the business is doing, which products are worth selling more of, and how to avoid losing money. This helps the business make smart decisions about pricing, what to sell, and how to manage costs.

EBITDA focuses on operating expenses and removes the effects of financing, accounting, and tax decisions. An income statement would have a much more detailed breakdown of the variable and fixed expenses. Variable costs are not consistent and are directly related to the product’s manufacture or sales. They tend to increase creating repeating invoices and bills in xero as a company scales products and decrease with production. Some other examples of fixed costs are equipment and machinery, salaries that aren’t directly related to the product’s manufacturing, and fixed administrative costs. To calculate sales, take the price of the product and multiply by the number of units sold.

Getting this calculation right can be time-consuming and relies on consistent reporting for fixed and variable earnings. A lot of companies use financial statement software to remove the headache. Quickly surface insights, drive strategic decisions, and help the business stay on track. The best contribution margin is 100%, so the closer the contribution margin is to 100%, the better. The higher the number, the better a company is at covering its overhead costs with money on hand.

Using a hypothetical company, let’s look at how a contribution margin income statement compares to a traditional income statement. A contribution income statement is a powerful tool in accounting and finance, providing valuable insights into a company’s financial performance. This guide will break down what a contribution income statement is, its components, and how it differs from a traditional income statement, with examples to enhance understanding. This means that the production of grapple grommets produce enough revenue to cover the fixed costs and still leave Casey with a profit of $45,000 at the end of the year.